CIT Bank federal tax ID number is crucial for accurate tax reporting and compliance. Understanding its purpose, location, and verification methods is essential for both individuals and businesses interacting with CIT Bank. This guide delves into the various ways to obtain CIT Bank’s federal tax ID number, highlighting the importance of accuracy and the potential consequences of errors. We’ll explore official channels for obtaining this information, methods for verification, and the implications of using incorrect tax data.

This comprehensive resource aims to clarify the process and ensure compliance.

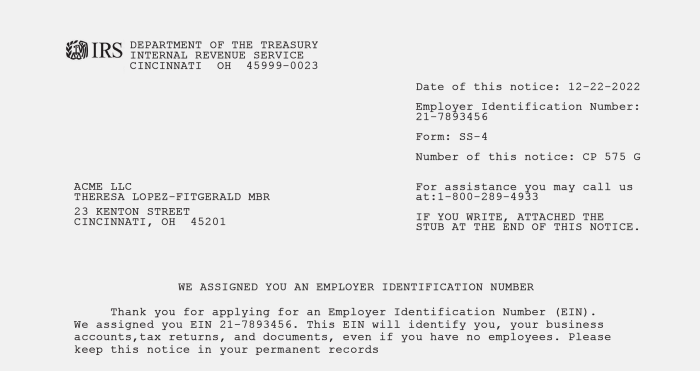

The federal tax ID number (also known as an EIN or Employer Identification Number) is a unique identifier assigned to businesses by the IRS. For financial institutions like CIT Bank, this number is vital for various tax-related processes, including filing tax returns, reporting income, and complying with regulatory requirements. Incorrectly using this number can lead to significant legal and financial repercussions, emphasizing the importance of accurate information.

Identifying CIT Bank’s Tax Information

This section details how to find CIT Bank’s federal tax ID number, the implications of using incorrect information, and a comparison of different tax IDs used by financial institutions.

CIT Bank’s Official Name and Parent Company

The official name of CIT Bank is CIT Group Inc. It’s important to note that CIT Group Inc. is the parent company, and the specific subsidiary providing banking services might have its own tax ID. This distinction is crucial for accurate tax reporting.

Methods for Finding a Company’s Federal Tax ID Number

Several methods exist for locating a company’s federal tax ID number (also known as an EIN, Employer Identification Number). These include searching the company’s official website (often in investor relations or legal sections), contacting the company’s customer support directly, or checking official government databases (though access may be limited).

Consequences of Using an Incorrect Tax ID Number

Using an incorrect tax ID number can lead to significant consequences, including delays in processing tax returns, penalties and interest charges from the IRS, and potential legal issues. It can also create complications for both the individual or business filing the return and the financial institution involved.

Format of a Federal Tax ID Number

A federal tax ID number typically consists of nine digits. For example, 12-3456789. While the hyphen is sometimes used for readability, it is not a required part of the number itself.

Comparison of Tax IDs Used by Financial Institutions

Financial institutions utilize various tax identification numbers depending on their structure and operations. The following table compares common types:

| Tax ID Type | Description | Used By | Relevance to CIT Bank |

|---|---|---|---|

| EIN (Employer Identification Number) | Used by corporations, partnerships, and other business entities. | CIT Group Inc. and its subsidiaries | Primary tax ID for CIT Bank’s operations. |

| SSN (Social Security Number) | Used by individuals. | Individual account holders at CIT Bank | Not the tax ID for CIT Bank itself. |

| TIN (Taxpayer Identification Number) | A general term encompassing both EINs and SSNs. | Both CIT Bank and its customers | Relevant for all tax reporting involving CIT Bank. |

| State Tax IDs | Vary by state; used for state tax purposes. | CIT Bank in each state of operation | Needed for compliance with state tax regulations. |

Understanding the Purpose of a Federal Tax ID Number

This section clarifies the role of a federal tax ID number for banking institutions like CIT Bank in tax reporting and compliance.

Right, so you’re tryna find that Cit Bank federal tax ID number, innit? Knowing that can be a proper faff, but it’s linked to their overall biz dealings. Check out this lowdown on the connection between Cit Bank and OneWest Bank – cit bank and onewest bank – as understanding their relationship might help you track down that ID number.

Knowing the history helps you navigate the paperwork, bruv.

Uses of a Federal Tax ID Number for Banking Institutions

A federal tax ID number is essential for banking institutions like CIT Bank for various purposes, including filing tax returns, opening business accounts, and complying with various regulatory requirements. It serves as a unique identifier for the institution’s tax-related activities.

Role in Tax Reporting and Compliance

The federal tax ID number is crucial for accurate tax reporting and compliance. CIT Bank uses its EIN to report its income, deductions, and withholdings to the IRS. Accurate reporting ensures the bank meets its tax obligations and avoids penalties.

Comparison to Other Business Identification Numbers

While similar in function, a federal tax ID number (EIN) differs from other business identification numbers like the state tax ID or a business license number. The EIN is specifically for federal tax purposes, while the others relate to state-level regulations or business registration.

Government Agencies Requiring a Federal Tax ID Number

Several government agencies require a federal tax ID number from financial institutions, primarily the Internal Revenue Service (IRS). Other agencies may also require it for specific reporting or regulatory purposes.

Documents Where CIT Bank’s Federal Tax ID Number Might Be Found

CIT Bank’s federal tax ID number may be found in several official documents, including:

- Annual reports

- Tax filings (Form 1120)

- Investor relations materials

- Legal documents

- 1099 forms issued to contractors

Locating CIT Bank’s Federal Tax ID Number Through Official Channels: Cit Bank Federal Tax Id Number

This section Artikels the steps involved in obtaining CIT Bank’s federal tax ID number through official channels.

Accessing CIT Bank’s Official Website

The most straightforward approach is to check CIT Bank’s investor relations section or a dedicated legal page on their official website. These sections often contain annual reports and other disclosures that may include the EIN.

Contacting CIT Bank’s Customer Support

Contacting CIT Bank’s customer support directly might yield results. However, they may not be able to provide this information readily, and may direct you to their investor relations department or other official channels.

Obtaining the Tax ID Number Through Government Databases

Accessing official government databases to directly obtain a company’s EIN is generally not possible for the public. Such databases are usually restricted to government agencies and authorized personnel.

Requesting Information via Mail

Sending a formal written request to CIT Bank’s corporate headquarters, clearly stating the need for their federal tax ID number, is another option. However, this method is likely to be the slowest.

Typical Response Time for Requests

Response times vary significantly depending on the chosen method. Checking the website is immediate. Customer support responses might take a few days. Mail requests could take several weeks.

Verification and Validation of the Federal Tax ID Number

This section details methods for verifying the authenticity of CIT Bank’s federal tax ID number.

Methods for Verifying Authenticity

Verifying the authenticity of a provided EIN involves cross-referencing the information found from multiple sources. Comparing the number obtained from the company website with any publicly available financial documents helps ensure consistency.

Resources for Validation, Cit bank federal tax id number

Source: upflip.com

While direct public access to IRS databases containing EINs is limited, consistency across multiple sources (company website, annual reports) significantly strengthens the verification.

Checking for Inconsistencies

Discrepancies in the tax ID number obtained from different sources should raise concerns. If inconsistencies exist, further investigation is necessary to determine the correct number.

Confirmation with Official Authorities

Direct confirmation with the IRS is generally not possible for the public. The IRS does not publicly verify EINs for privacy reasons.

Flowchart Illustrating the Verification Process

A flowchart would visually represent the verification process: Start with obtaining the EIN from multiple sources (website, reports), compare the numbers for consistency, and if inconsistencies exist, further investigation is needed. If consistent across multiple trusted sources, the verification is considered complete.

Potential Implications of Using Incorrect Tax Information

Source: taxuni.com

This section explores the legal and financial implications of using an incorrect tax ID number.

Legal and Financial Implications

Using an incorrect tax ID number can lead to severe legal and financial repercussions, including penalties, interest charges, and potential audits from the IRS. It could also cause delays in tax processing and create complications for both the filer and the recipient of the tax information.

Penalties Associated with Inaccurate Tax Information

The IRS imposes penalties for inaccurate tax information, varying depending on the nature and severity of the error. Penalties can range from financial fines to legal action.

Importance of Accurate Tax Reporting

Accurate tax reporting is crucial for both individuals and businesses to maintain compliance with tax laws and avoid legal and financial penalties. It ensures the smooth functioning of the tax system and supports government operations.

Scenarios Leading to Significant Issues

Using the wrong tax ID could lead to rejection of tax filings, delays in receiving refunds, and even legal action. It could also impact credit ratings and business relationships.

Narrative Illustrating Consequences

Source: investopedia.com

Imagine a business filing its tax return with an incorrect EIN. The IRS rejects the return, resulting in penalties and interest charges. The business faces delays in its operations and potential damage to its reputation. This simple mistake could have significant and long-lasting financial consequences.

Concluding Remarks

Securing and verifying CIT Bank’s federal tax ID number is a critical step in ensuring accurate financial transactions and compliance with tax regulations. This guide has provided a roadmap for obtaining this information through official channels, verifying its authenticity, and understanding the serious implications of using incorrect data. Remember, accuracy in tax reporting is paramount for both individuals and businesses, safeguarding against potential penalties and ensuring smooth financial operations.

Always prioritize using official resources and verification methods to ensure the integrity of your financial interactions with CIT Bank.