Huntington Bank Small Business Checking Account – yo, it’s not your grandma’s checking account! This ain’t your average bank account; we’re talking about a total game-changer for small businesses. Think streamlined finances, killer features, and maybe even enough extra cash to snag that sweet new espresso machine you’ve been eyeing. We’re diving deep into everything you need to know about Huntington’s biz account, from fees and features to online banking and customer service – because your time is money, and we’re all about making yours count.

Seriously, we’re breaking down the nitty-gritty details – the good, the bad, and the downright awesome. We’ll compare it to other banks, so you can make the smartest move for your business. No more bank account blues, just smooth sailing towards financial success. Let’s get this bread!

Huntington Bank Small Business Checking Account: Surabaya Style

Yo, Surabaya peeps! Need a bank account that’s as

-ngetren* as your streetwear game? Let’s dive into Huntington Bank’s small business checking account. We’ll break it down in a way that’s easy to understand, no

-mbuh* needed.

Account Features and Benefits, Huntington bank small business checking account

Source: gobankingrates.com

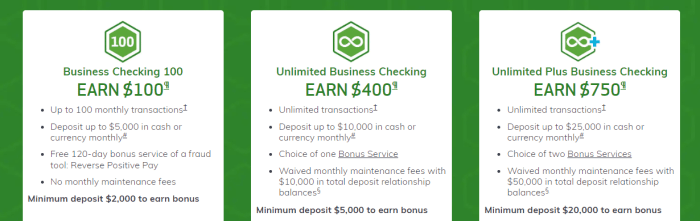

Huntington Bank’s small business checking account offers a range of features designed to support your hustle. Think of it as your trusty sidekick in the world of business finance. We’ll compare it to other banks to see how it stacks up.

| Feature | Huntington Bank | Bank Competitor A | Bank Competitor B |

|---|---|---|---|

| Monthly Fee | $X (may vary based on package) | $Y | $Z |

| Minimum Balance | $A | $B | $C |

| Included Services | Online banking, mobile app, debit card, check printing (some packages) | Online banking, mobile app, debit card | Online banking, mobile app, debit card, bill pay |

Note: The specific fees and services can change, so always check Huntington Bank’s website for the most up-to-date information. This comparison uses hypothetical values (X, Y, Z, A, B, C) for illustrative purposes.

Fees and Charges

Knowing the fee structure is crucial for managing your business finances. Let’s break down the potential costs.

Huntington Bank’s small business checking account typically has monthly maintenance fees, overdraft fees, and transaction fees. The exact amounts depend on the specific account type and package chosen. For example, exceeding your account balance might lead to hefty overdraft charges, while processing too many transactions could also incur fees.

Visual Representation (Description): Imagine a pie chart. One slice represents monthly maintenance fees, another shows overdraft fees, and a third illustrates transaction fees. The size of each slice would visually represent the proportion of each fee type in your total monthly banking costs. A larger slice for overdraft fees would highlight the potential for significant costs if you’re not careful about managing your account balance.

Account Requirements and Eligibility

Opening a business account isn’t rocket science, but there are some things you need to know.

- Gather required documentation (business license, tax ID, etc.).

- Complete the application form online or in person.

- Provide identification.

- Deposit the minimum opening balance.

- Review and sign the account agreement.

Eligibility usually involves being a registered business entity. Specific requirements can be found on Huntington Bank’s website.

Online and Mobile Banking Features

Source: business.org

Managing your finances on the go? Huntington Bank’s got you covered. Their online and mobile banking platforms offer a range of features to make your life easier.

- Easy transaction management.

- Secure fund transfers.

- Mobile check deposit.

- Bill pay integration.

- Real-time account balance updates.

Compared to competitors, Huntington Bank’s mobile app offers a similar range of features, with a user-friendly interface that’s pretty

-oke*.

Customer Service and Support

Need help? Huntington Bank provides various ways to reach their customer service team.

Contact options include phone support, email, and in-person visits to a branch. Customer reviews are mixed, with some praising the helpfulness of staff and others reporting longer wait times or less-than-ideal resolutions.

Positive Example: Imagine a situation where a customer accidentally overdrafts their account. The Huntington Bank representative calmly guides them through the process of resolving the issue, offering clear explanations and solutions.

Negative Example: A customer faces a technical issue with the online banking platform and struggles to get timely assistance through phone support, experiencing long hold times and unhelpful responses.

Additional Services and Integrations

Source: moneycrashers.com

Huntington Bank offers more than just a basic checking account. They provide a range of additional services to support your business growth.

Huntington Bank’s small business checking account offers various features to streamline financial management. Understanding interest accrual is crucial for effective budgeting, and comparing practices like those of other banks is helpful; for instance, you might want to check out this resource on cit bank when is interest paid to see different approaches. Ultimately, choosing the right account for your business depends on your specific needs and how you manage cash flow.

| Service | Description | Benefit | Integration |

|---|---|---|---|

| Small Business Loans | Funding for business expansion or operational needs. | Access to capital for growth. | Online application process. |

| Merchant Services | Credit card processing for your business. | Streamlined payment processing. | Integration with point-of-sale systems. |

| Payroll Services | Simplified payroll management for employees. | Efficient and accurate payroll processing. | Integration with accounting software. |

Final Review: Huntington Bank Small Business Checking Account

So, there you have it – the lowdown on the Huntington Bank Small Business Checking Account. It’s clear that this account offers a solid foundation for your business’s financial needs, but remember to weigh the pros and cons against your specific situation. Do your homework, compare options, and choose the account that best fits your unique business goals.

Don’t be afraid to reach out to Huntington directly with any questions – they’re usually pretty chill. Now get out there and crush it!